Insightful Chronicles

Exploring the world through news and stories.

Is Pet Insurance Worth It? Let's Find Out!

Uncover the truth about pet insurance! Discover if it's the safety net your furry friend needs or just a financial burden.

Understanding the Costs: Is Pet Insurance a Smart Investment?

Pet ownership comes with a myriad of responsibilities, and one of the most critical decisions a pet owner faces is whether to invest in pet insurance. With the rising costs of veterinary care, which can escalate due to unexpected accidents or illnesses, understanding the potential expenses is essential. According to various studies, a single emergency visit can range from $300 to over $1,500, depending on the treatment required. This uncertainty in veterinary costs makes pet insurance an attractive option for many pet owners, as it can help mitigate financial burdens and ensure pets receive timely medical attention.

When evaluating whether pet insurance is a smart investment, it’s important to consider factors such as the type of plan, monthly premiums, and the coverage details. There are generally two types of policies: accident-only and comprehensive. While accident-only plans are typically more affordable, they only cover injuries, leaving illness-related expenses exposed. On the other hand, comprehensive plans offer broader coverage, including routine care, which can enhance overall savings. Ultimately, balancing these costs against potential veterinary expenses can help pet owners make a more informed decision about the right path for their furry companions.

The Pros and Cons of Pet Insurance: What You Need to Know

Pet insurance can be a valuable investment for pet owners, offering peace of mind and financial protection against unexpected veterinary expenses. One of the primary advantages is that it allows for better access to potential treatments and care options, especially in emergencies when costs can quickly add up. Additionally, many policies offer coverage for both routine care, such as vaccinations, and unexpected illnesses or accidents. This means that by paying a monthly premium, pet owners can avoid the stress of exorbitant bills that could arise from serious health issues. This proactive approach to your pet's health can lead to longer, better quality lives for furry companions.

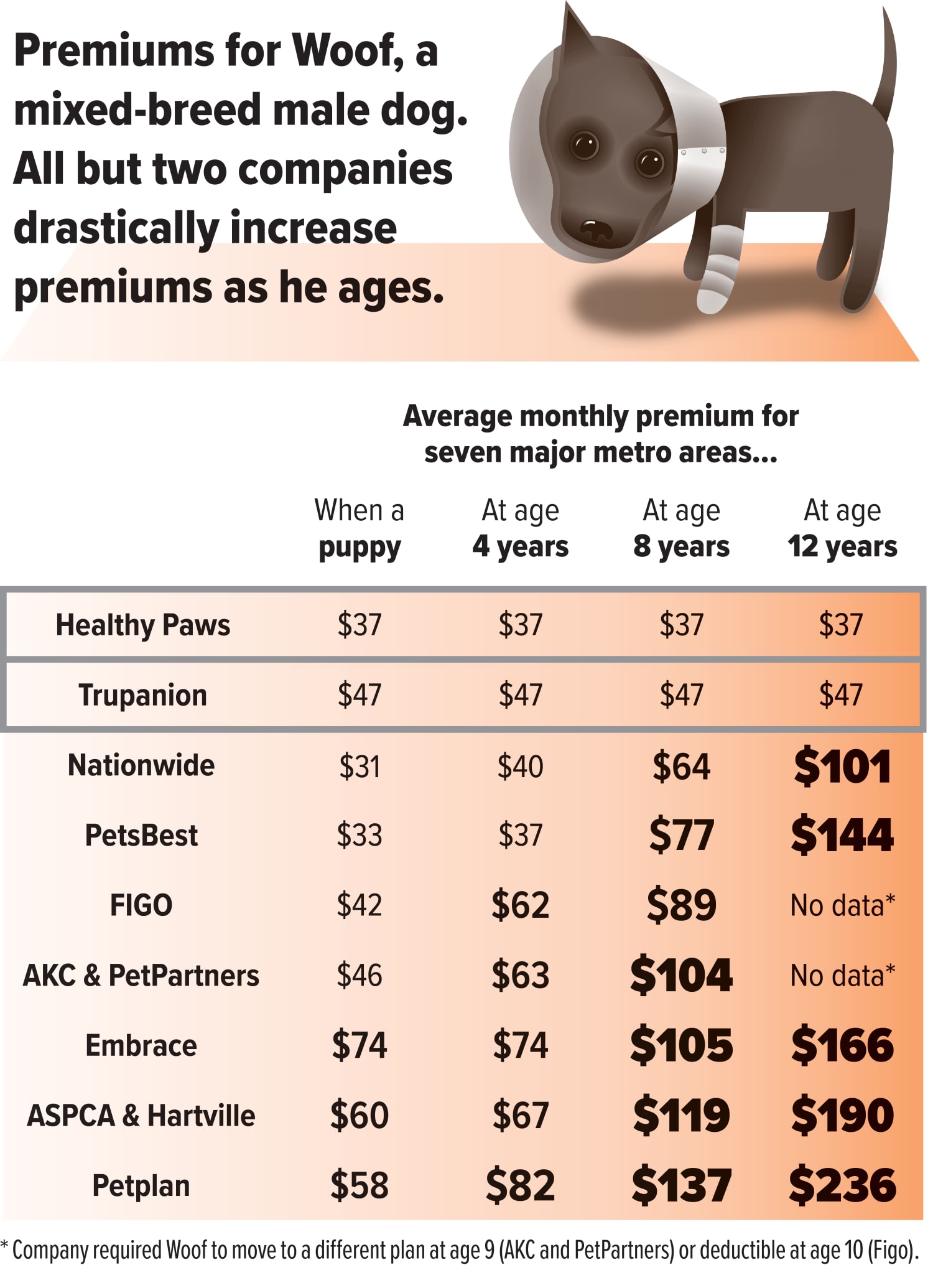

However, it's essential to consider the drawbacks of pet insurance as well. One of the major downsides is the cost; monthly premiums can add up, especially for older pets or breeds at higher risk for certain conditions. Furthermore, many policies come with exclusions or waiting periods that may limit coverage for pre-existing conditions, which can leave owners feeling frustrated. Lastly, the wide range of plans available can be confusing, making it challenging to choose the best fit for your pet's specific needs. Evaluating both the pros and cons will help you make an informed decision about pet insurance.

What to Consider Before Buying Pet Insurance: Key Questions Answered

Before purchasing pet insurance, it's crucial to ask yourself several key questions to ensure you make an informed choice. First, consider the coverage options available. Does the policy cover accidents, illnesses, and preventive care? Make a list of what’s important for your pet's health needs and look for policies that align with those priorities. Additionally, think about the deductibles and premiums; how much are you willing to pay monthly and what amount would you be comfortable covering out-of-pocket in case of a vet visit?

Another vital factor is the network of vets associated with the insurance provider. Can you continue seeing your preferred veterinarian, or are you restricted to specific clinics? Furthermore, review any exclusions in the policy—some plans may not cover certain breeds or pre-existing conditions. Lastly, consider the claim process; is it straightforward, and how quickly do they reimburse for veterinary expenses? Knowing the answers to these questions can help you select the right pet insurance that protects both your pet’s health and your finances.