Insightful Chronicles

Exploring the world through news and stories.

Term Life Insurance: The Safety Net You Didn't Know You Needed

Discover how term life insurance can be your unexpected safety net—protect your loved ones and gain peace of mind today!

Understanding the Benefits of Term Life Insurance: Protecting Your Family's Future

Term life insurance is a financial safety net that provides a death benefit to your beneficiaries, ensuring that they are protected financially in the event of your untimely passing. This type of policy is particularly beneficial for families who have specific financial obligations, such as a mortgage or education costs for children. By securing a term life insurance policy, you can offer peace of mind, knowing that your loved ones will have the necessary funds to maintain their standard of living and meet their future needs, even in your absence.

Another major advantage of term life insurance is its affordability. Compared to whole life insurance, term policies are generally much less expensive, allowing you to obtain higher coverage amounts at a lower premium. This affordability means that individuals can invest in a policy that lasts for a specific period—typically 10, 20, or even 30 years—during which their family is most vulnerable. Therefore, understanding the benefits of term life insurance is crucial for anyone looking to protect their family's future without breaking the bank.

Common Misconceptions About Term Life Insurance Explained

Term life insurance is often surrounded by misconceptions that can lead to confusion for potential policyholders. One common belief is that these policies do not pay out if the insured individual lives past the term period. In reality, term life insurance is designed to provide coverage for a specified period—typically 10, 20, or 30 years. If the policyholder passes away during this time, their beneficiaries receive the death benefit. However, if the individual survives beyond the term, the coverage simply ends without any payout. This limitation often raises concerns, but understanding that it is primarily designed for temporary financial protection is key when considering different life insurance options.

Another prevalent myth is that term life insurance is not a worthwhile investment because it doesn’t build cash value. While it’s true that term policies do not accumulate cash value like whole life insurance, they offer significantly lower premiums for the same amount of coverage. This affordability makes term life an attractive option, especially for families looking to secure financial stability during crucial years such as raising children or paying off a mortgage. In fact, individuals can invest the money saved on premiums into other financial vehicles that may yield a better return over time, making term life insurance a practical choice for many.

Is Term Life Insurance Right for You? Key Factors to Consider

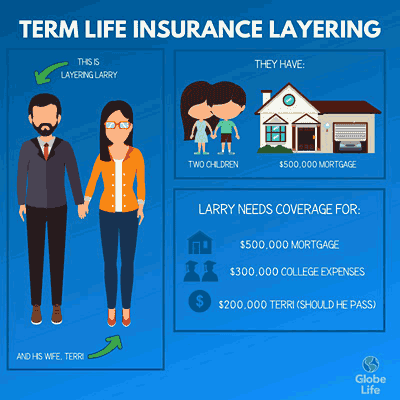

When considering term life insurance, it's essential to evaluate your personal financial situation and future goals. Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years, making it a budget-friendly option for those seeking to secure their family's financial future in the event of an untimely demise. Key factors to consider include your current income, outstanding debts, and the financial needs of your dependents. Assess whether the coverage amount aligns with your long-term financial obligations, such as mortgage payments, education costs for children, and other living expenses.

Additionally, consider your age and overall health when deciding if term life insurance is right for you. Younger individuals often benefit from lower premiums, making it an opportune time to secure affordable coverage. It's also crucial to evaluate whether your lifestyle choices, like smoking or high-risk activities, could affect your premiums. Ultimately, understanding these factors can help you determine if term life insurance is a suitable choice for your financial plan and peace of mind.