Insightful Chronicles

Exploring the world through news and stories.

Insurance Wars: May the Best Policy Prevail!

Discover the ultimate showdown of insurance policies! Find out which coverage reigns supreme and saves you the most. Don't miss this battle!

The Ultimate Showdown: Comparing Health Insurance Plans

When it comes to choosing the right health insurance plan, understanding the differences between various options is crucial. The Ultimate Showdown: Comparing Health Insurance Plans begins with a thorough analysis of the types of plans available, such as Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs). Each plan type offers unique benefits and limitations, impacting your out-of-pocket costs and provider choices. For example, while HMOs may require you to choose a primary care doctor and get referrals to see specialists, PPOs offer greater flexibility in choosing providers. Before selecting a plan, carefully assess your healthcare needs and budget to find the best fit.

Another essential factor in the showdown is understanding the specific coverages offered by different plans. Comprehensive coverage should include essential health benefits such as emergency services, maternity care, and mental health support. Additionally, consider costs like deductibles, copayments, and premiums, as these can vary significantly between plans. To make an informed decision, it’s advisable to utilize comparison tools like Healthcare.gov's plan finder or speak with a licensed insurance agent. These resources can help you evaluate the pros and cons of each plan, ensuring you select the health insurance plan that meets your personal health and financial needs most effectively.

What You Need to Know About Auto Insurance: Key Features Explained

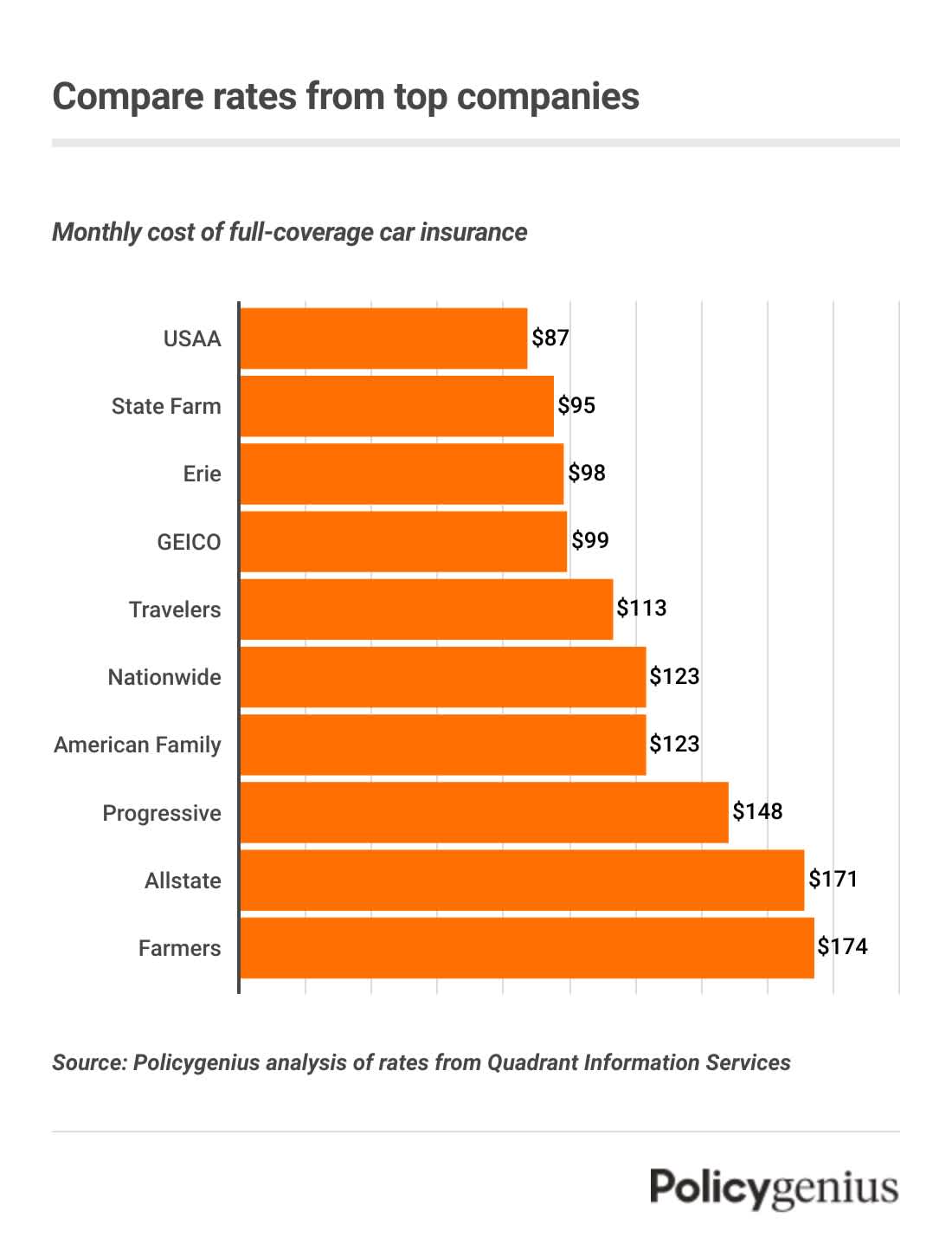

Auto insurance is an essential requirement for all vehicle owners, providing financial protection in case of accidents, theft, or damage. To understand the importance of auto insurance, it's crucial to be aware of its key features. These generally include liability coverage, which covers the costs associated with damages to another party if you're found at fault in an accident; collision coverage, responsible for repairs to your vehicle after an accident; and comprehensive coverage, which protects against non-collision related incidents such as theft or natural disasters. For more in-depth knowledge, check out the Consumer Reports guide on auto insurance.

Another important feature to consider is uninsured/underinsured motorist coverage, which safeguards you in situations where the at-fault party lacks sufficient coverage. Additionally, don't overlook optional features such as personal injury protection (PIP) or medical payments coverage, which can cover medical expenses for you and your passengers in case of an accident. Understanding these aspects not only helps you choose the right policy but also ensures you're adequately protected while on the road. For further details, refer to the Nationwide resource on types of auto insurance.

Which Life Insurance Policy is Right for You? A Comprehensive Guide

Choosing the right life insurance policy can be a daunting task, as it involves evaluating your personal financial situation, family needs, and future goals. There are several types of life insurance policies available, each with its unique features and benefits. The two main categories are term life insurance and whole life insurance. Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years, making it an excellent option for young families looking for affordable premiums. On the other hand, whole life insurance offers lifelong coverage and a cash value component, which can serve as a savings tool. To learn more about the differences between these policies, you may refer to resources like Investopedia.

Before making a decision, it's essential to assess your current financial obligations and future needs. Consider factors such as:

- Your age and health

- The number of dependents relying on your income

- Your outstanding debts, like a mortgage or student loans

- Your long-term financial goals, like funding a child's education